Calculating federal income tax per pay period

FICA taxes consist of Social Security and Medicare taxes. These are the rates for.

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

Ad Guaranteed Results From A BBB Firm With 28 Years In Practice.

. There are seven federal tax brackets for the 2021 tax year. Your bracket depends on your taxable income and filing status. Employers will increase withholding by the per pay period tax amount in Step 4c.

The 2022 Tax Calculator uses the 2022 Federal Tax Tables and 2022 Federal Tax Tables you can view the latest tax tables and historical tax tables used in our tax and salary calculators here. Federal Income Tax Deductions. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

For example if an employee makes 40000 annually and is paid biweekly divide their annual wages 40000 by 26 to get their total gross pay for the period 40000 26. To calculate Federal Income Tax withholding you will need. 2020 Federal income tax withholding calculation.

Our income tax calculator calculates your federal state and local taxes based on several key inputs. The per pay period input refers to federal income tax withheld per paycheck. Now that we understand period payments the next step is learning the elements that make up federal income taxable wages from which withholding is calculated.

Then look at your last paychecks tax withholding amount eg. Calculate your net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into. Your household income location filing status and number of personal.

Ad Calculate Your Tax Refund For Free And Get Ahead On Filing Your Tax Returns Today. Estimate how much youll owe in federal taxes using your income deductions and credits all in just a few steps with our tax calculator. Ad Estimate Your Taxes and Refunds Easily With This Free Tax Calculator from AARP.

That result is the tax withholding amount. Federal income taxes are generally based on the marital status and number of allowances you claim on your W-4 form. 69400 wages 44475 24925 in wages taxed at 22.

10 12 22 24 32 35 and 37. These amounts are paid by both employees and employers. The employees adjusted gross pay for the pay.

Form W-4 for 2020 or later or was first paid wages in 2020 or later add the amount shown in Table 2 to their. Know Your OptionsSpeak To One Of Our Experienced CPA IRS Enrolled Agents Now. In addition you need to calculate 22 Column D of the earnings that are over 44475 Column E.

Pay period This is how. Subtract 12900 for Married otherwise. Federal Salary Paycheck Calculator.

Know Your OptionsSpeak To One Of Our Experienced CPA IRS Enrolled Agents Now. For 2022 employees will pay 62 in Social Security on the. Calculate Federal Income Tax FIT Withholding Amount.

Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes. This is 548350 in FIT. Multiply taxable gross wages by the number of pay periods per year to compute your annual wage.

For current jobs we will ask for federal income tax withheld per pay period and year-to-date. 250 minus 200 50. 250 and subtract the refund adjust amount from that.

The amount is the employees gross wages for the pay period. Ad Guaranteed Results From A BBB Firm With 28 Years In Practice.

How To Calculate Federal Income Tax

How To Calculate Payroll Taxes Methods Examples More

Payroll Taxes How Much Do Employers Take Out Adp

How To Calculate Federal Income Tax

How To Calculate 2020 Federal Income Withhold Manually With New 2020 W4 Form

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

Paycheck Taxes Federal State Local Withholding H R Block

Defense Finance And Accounting Service Civilianemployees Civilian Permanent Change Of Station Pcs Civilian Pcs Entitlement Guide Relocation Income Tax Allowance Rita

How To Calculate Federal Income Tax

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

Excel Formula Income Tax Bracket Calculation Exceljet

What Is Local Income Tax Types States With Local Income Tax More

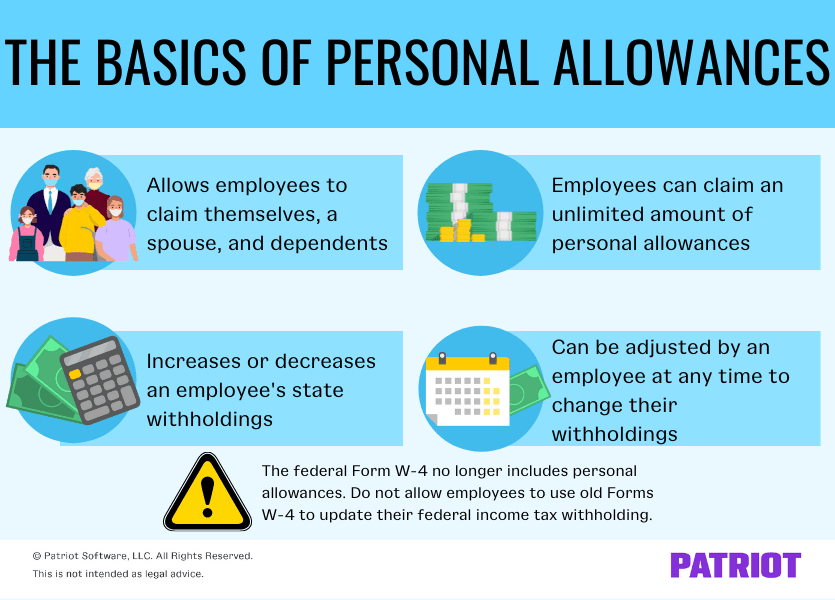

Personal Allowances What They Are What They Do Who Uses Them

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

How To Calculate Federal Income Tax

2022 Federal State Payroll Tax Rates For Employers

The Basics Of Payroll Tax Withholding What Is Payroll Tax Withholding